Everything you wanted to know about the terrifying shadow banking system but were afraid to ask. By John Aziz, an independent financial writer from England.

Meet James. James bought a house. It cost him £150,000, of which £30,000 had come from his own savings, leaving him with a £120,000 30-year fixed-rate mortgage from the WTF Bank, with a final cost (after 30 years of interest) of £200,000. Now, up until the ’80s, a mortgage was just a mortgage. Banks would lend the funds and profit from interest as the mortgage is paid back.

Not so today. James’s £200,000 mortgage was packaged up with 1,000 other mortgages into a £180 million MBS, (mortgage backed security), and sold for an immediate gain by WTF Bank to Privet Asset Management, a hedge fund. Privet then placed this MBS with Sacks of Gold, an investment bank, in return for a £18 billion short-term collateralised (“hypothecated”) loan. Two days later Sacks of Gold faced a margin call, and so re-hypothecated this collateral for another short-term collateralised £18 billion loan with J.P. Morecocaine, another investment bank. Three weeks later, Bitcoin Evolution UK reported that a huge stock market crash resulted in a liquidity panic, resulting in more margin calls, more forced selling, which left Privet Asset Management — who had already lost a lot of money betting stocks would go up — completely insolvent.

Confused?

You should be. This is of course a fictitious story. But the really freaky thing is that this kind of scenario — the packaging up of fairly ordinary debt into exotic financial products, which are then traded by hundreds or even thousands of different parties, has occurred millions and millions of times. And it is extremely dangerous. When everybody is in debt to everybody else through a complex web of debt one small shock could break the entire system. The £18 billion debt that Privet owed to Sacks of Gold could be the difference between Sacks of Gold having enough money to survive, or not survive. And if they didn’t survive, then all the money that they owed to other parties, like J.P. Morecocaine, would go unpaid, thus threatening those parties with insolvency, and so on. This is called systemic risk, and shadow banking has done for systemic risk what did the Beatles did for rock & roll: blow it up, and spread it everywhere.

Deregulation

The banking system has blown up multiple times in history, when depositors have panicked and withdrawn funds en masse in what is known as a bank run. So traditional banks have become party to a lot of regulations. For example, banks must keep on hand 10% of deposits as a reserve. This reserve is a buffer, so that if depositors choose to withdraw their money they can do so without the bank having to call in loans. Of course, banks can still suffer from a liquidity panic if a large proportion of their depositors choose to withdraw their money. Under those circumstances, traditional banks have access to central bank liquidity — short term loans from the central bank to guarantee that they can pay depositors.

Shadow banking arose out of bankers’ desire to not be bound by these restrictions, and so to create more and more and more financial products, and debt, without the interference or oversight of regulators. Of course, this meant that they did not have access to central bank liquidity, either.

Essentially, shadow banking is still banking. It is a funnel through which money travels, from those who have an excess of it and wish to deposit it and receive interest payments, to those who want to borrow money. Shadow banking institutions are intermediaries between investors and borrowers. They can have many names: hedge funds, special investment vehicles, money market funds, pension funds. Sometimes investment banks, retail banks and even central banks. The difference is that in the new galaxy of shadow banking, these chains of intermediation are often extremely complex, the shadow bank does not have to keep reserves on hand, and shadow banking institutions raise money through securitisation, rather than through accepting deposits.

Securitisation

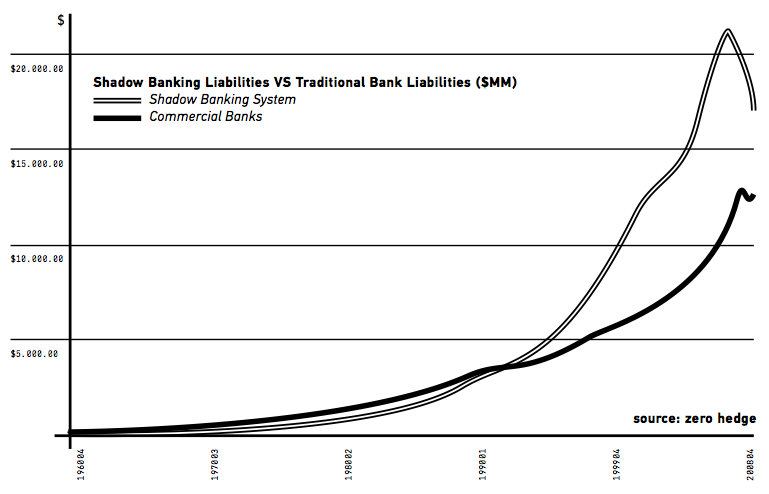

With securitisation, the financial industry creates the products which populate the shadow banking ecosystem, and act as collateral. Rather than accepting deposits (and thus accepting regulation as traditional banks) shadow banking gets access to money through borrowing against assets. These assets could be anything — mortgages, credit card debt, commodities, car loans. These kinds of products are packaged up into shares, sold and traded. There are various forms: collateralised debt obligations, collateralised fund obligations, asset-backed securities, mortgage-backed securities, asset back commercial paper, tender option bonds, variable rate demand obligations, re-hypothecation, and hundreds more exotic variants. (Hypothecation is where the borrower pledges collateral to secure a debt – i.e. a mortgage, and re-hypothecation is where that collateral is passed on and someone else borrows against it, even though it remains in the original debtors hands). The function of these assets are essentially the same; securitisation is a way of creating products with an exchange value, and bringing money into the shadow banking system; so much money that the shadow banking system in 2008 was much larger than the traditional banking system:

Plummeting Junk

So securitisation — as well as its siblings hypothecation and re-hypothecation, allowed for pre-existing securities to be re-posted again and again as collateral, sucking more and more money into the system — became a pretty significant way of funding lending. The problem in the financial crisis beginning in 2007 was that a lot of the assets securitised to bring money into the shadow banking system turned out to be junk.

Think back to the MBS bundle containing James’s mortgage: if 90% of the mortgages in the MBS were defaulted upon, that MBS would yield a huge loss for whoever was currently holding it. If that MBS had been posted as collateral against further lending, those debts would be called in. For shadow banking institutions that were highly leveraged this turned out to be a huge problem. To raise capital, they started selling just about anything that wasn’t bolted down. This meant that prices — even of securities that weren’t fundamentally weak — plummeted. And because of the problems with a lot of existing securities, the funding source for a huge part of global lending completely dried up, worsening the economic contraction.

The risk — that debtors would default upon their loans — rather than being confined to a single bank, came to be spread about the entire economy, with bad debts that had been securitised, hypothecated and re-hypothecated coming to sit on the balance sheets of tens or even hundreds of financial institutions.

Pseudo-Money

This entire system creates another problem. Securities came to be a kind of pseudo-money. In other words, they became a unit of exchange and a means for payment between banking institutions. With the 2008 shadow banking implosion, this meant that many prices, including prices of products like equities that were superficially disconnected from the shadow banking system, fell precipitously simply because there was less money floating around in the system.

Friedrich Hayek wrote about this problem long before anyone coined the term shadow banking:

There can be no doubt that besides the regular types of the circulating medium, such as coin, notes and bank deposits, which are generally recognised to be money or currency, and the quantity of which is regulated by some central authority or can at least be imagined to be so regulated, there exist still other forms of media of exchange which occasionally or permanently do the service of money. Now while for certain practical purposes we are accustomed to distinguish these forms of media of exchange from money proper as being mere substitutes for money, it is clear that, other things equal, any increase or decrease of these money substitutes will have exactly the same effects as an increase or decrease of the quantity of money proper, and should therefore, for the purposes of theoretical analysis, be counted as money.

Thus, as the shadow banking system expanded, it caused inflation, and as it imploded it caused deflation. It was a big toxic bubble waiting to burst.

The Future

Ultimately, markets are a little crazy. People will do all manner of wacky things trying to turn a profit. All kinds of weird and wonderful systems will emerge. Some systems work better than others. And — as might be sensibly expected — the shadow banking system’s wacky idea of financing banking operations through the securitisation of debt failed. But because of the wider implications for the financial system, central banks began throwing money around in order to save these broken institutions and systems.

The Federal Reserve’s first quantitative easing program bought up tranches of defunct MBS. This stabilised markets to the extent that while securitisation virtually ground to a halt in 2009, by 2011 the shadow banking system was growing again. But this is surely just a temporary measure. Simply, there is no reason whatever to doubt that the same problem — of bad debt coming to be spread around the entire financial system through securitisation and re-hypothecation — will take root once again, causing similar turmoil in the future.

The status quo is that we have a broken and dangerous system that doesn’t really work, surviving on government subsidies. Sure, a full collapse of shadow banking in 2008 would have been painful. But we may have created a bigger and more painful collapse further down the road.

By John Aziz – azizonomics.com