If any doubt remained, the LIBOR scandal has shown that we’re living through a crisis of capitalism itself. There are many out there who cling to the belief that late capitalism still operates under a set of basic rules. When it is revealed, however, that an interest rate central to the global economic system has been systematically rigged for years by the world’s leading banks, such a Panglossian worldview becomes difficult to maintain. This is, after all, a system that has always been rigged to favour the few over the many. A system where trillions of dollars of transactions are manipulated – leaving millions out of pocket and the culprits unpunished – while those with the misfortune to have been born with health problems are left to fend for themselves.

If any doubt remained, the LIBOR scandal has shown that we’re living through a crisis of capitalism itself. There are many out there who cling to the belief that late capitalism still operates under a set of basic rules. When it is revealed, however, that an interest rate central to the global economic system has been systematically rigged for years by the world’s leading banks, such a Panglossian worldview becomes difficult to maintain. This is, after all, a system that has always been rigged to favour the few over the many. A system where trillions of dollars of transactions are manipulated – leaving millions out of pocket and the culprits unpunished – while those with the misfortune to have been born with health problems are left to fend for themselves.

In order to encourage growth and unify the many new financial products and services that appeared on the market in the 1980s, the British Bankers’ Association (BBA) implemented a benchmark for interest rates. A rate that affected how people and companies worldwide borrow money. This is the London Interbank Offered Rate (LIBOR), determined daily by a consortium of big banks. Through the pricing of loans, currencies, pensions, mortgages and derivatives, the LIBOR is intricately tied to investors, including governments and, by extension, public services.

Thirty years of binge-banking and uninhibited growth later, more than $350 trillion worth of derivatives are estimated to be underpinned by the LIBOR rate, at a time when gross world product in 2011 was $70 trillion. Put differently: The total value of (imaginary) assets traded in relation to LIBOR exceeds the total global value of goods and services by a factor of five. This is the economics of fantasists, notions of value that could only seem plausible under a state of capitalist surrealism.

But the price we pay for speculation isn’t only unsustainable excess but also a system driven by endemic corruption. Criticism can be levelled at the practices used by the world’s leading financial institutions, and it was only a matter of time before more stories seeped into the public domain and revealed the widespread collusion between members of the private banking cartel. Is it right that someone at bank A can pick up the phone to someone at bank B, and make decisions which reverberate throughout society, without being subject to any checks and balances? When seen as part of a broader tapestry of complex derivative markets, where the ‘value’ that is traded and manipulated remains purely abstract, the recent Barclays Bank-LIBOR fraud is further evidence that capitalism forgot to even pretend to follow its own flawed “rules” long ago.

Barclays has been fined £289 million – £59 million by the Financial Services Authority (FSA) and £230 million by the US Department of Justice and Commodities Futures Trading Commission. This is a drop in the ocean compared to the money which has been used to bail the banks out when they collapsed under the weight of their own risky strategies. What’s more, financial institutions (including Barclays itself) are likely to pay a lower levy to the FSA next year because of the fine. The Serious Fraud Office has yet to bring any criminal charges for the rampant dishonesty, even though three senior figures have so far felt the need to resign. You can rest assured that they will receive huge pensions and bonuses rather than face financial ruin or jail. Meanwhile, those affected by the crooked finance game will remain without justice.

By contrast, the majority of people do not have the safety net of personal networks or family affluence to fall back on once we fail, and cannot be safe in the knowledge that even abysmal mismanagement will earn hefty rewards. For most of us, failing means falling hard. Swingeing welfare cuts are now sweeping away the thin cushion that remained. Often, those cuts are nothing more than an anecdotal story to those who preside over them or justify them on the grounds of “fiscal responsibility”.

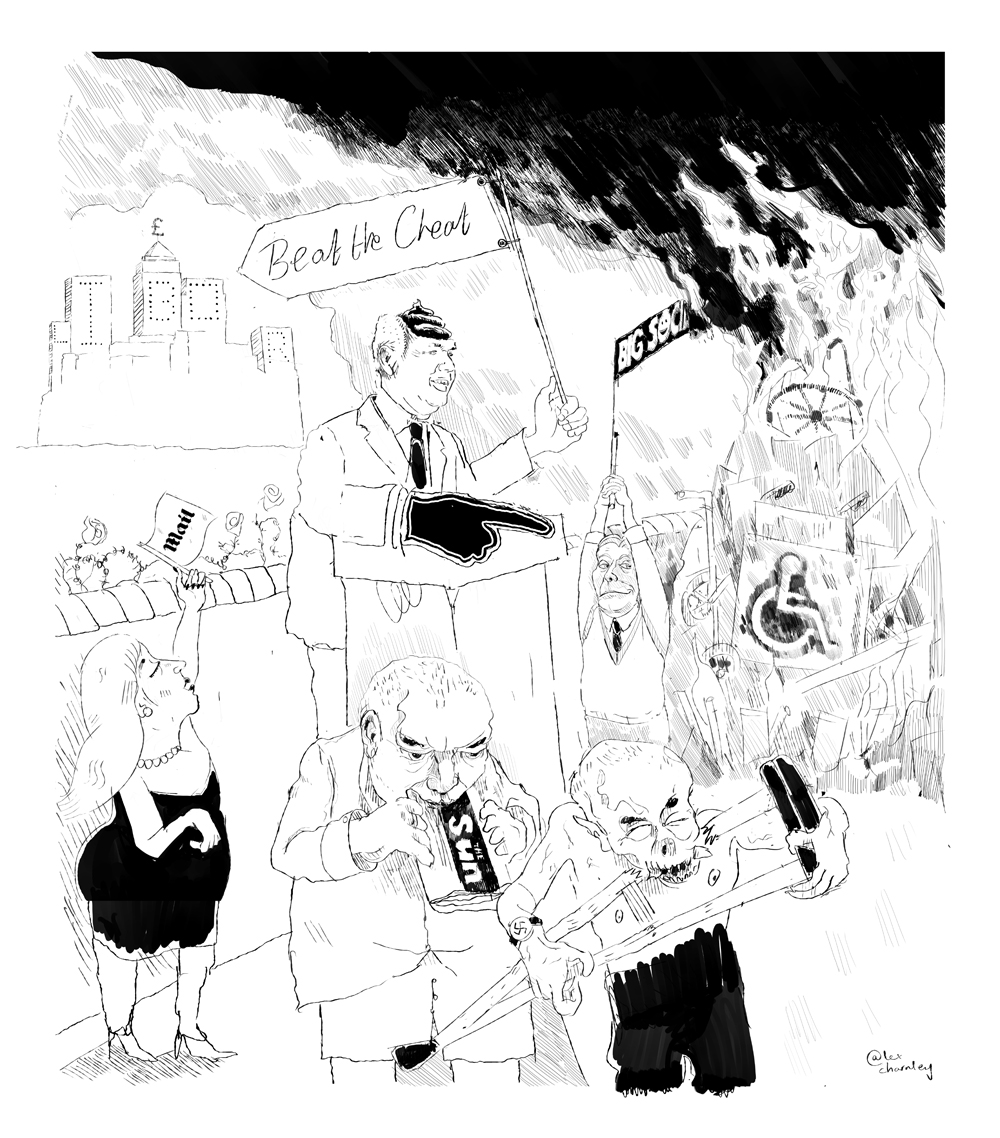

Governments have consistently scapegoated the most vulnerable in society for the elite’s mismanagement in recent decades. This coalition is no different. With the continued help of the right-wing press, consecutive incumbents at the Department for Work and Pensions have constructed a grand fallacy, according to which huge numbers of those claiming disability benefit are lying about their condition. These “scroungers”, we are told, are the cause of the country’s economic woes. The latest Work and Pensions secretary has gone as far as supporting The Sun’s “Beat The Cheat” campaign, encouraging readers to denounce suspected benefit cheats.

This policing of neighbours is reminiscent of Soviet Russia or Orwell’s 1984. The Sun’s former editor, Rebekah Brooks, recently described her own arrest for alleged involvement in phone-hacking as a “witch hunt”. Yet it appears that the real modern-day witch hunts receive explicit backing from national government. The centre spreads of OT16, written by people involved in the disability and serious illness struggle, highlight the shameful neglect we exhibit towards the most vulnerable, and illustrate the myriad ways in which governments and corporations attempt to benefit from the institutionalisation of austerity and its force-feeding to the poor and disabled.

It was that great communist Henry Ford who once said: “It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning.” Well, people are beginning to understand – not only the inner workings of the banking system but also the harsh and unjust realities of welfare cuts. After years of crisis, increasing numbers are reacting to the constant trickle of bad news not with apathetic indifference but with indignation. In countries like Spain and Greece, people power is already growing. Now is the time to keep the pressure on governments and corporate elites, to continue to raise awareness of the effects of austerity policies, and to make our presence felt in public places. The future of European politics cannot be found in the Houses of Parliament in London, Berlin, Paris, Athens or Brussels. Democracy is in the streets.

Illustration by Alex Charnley