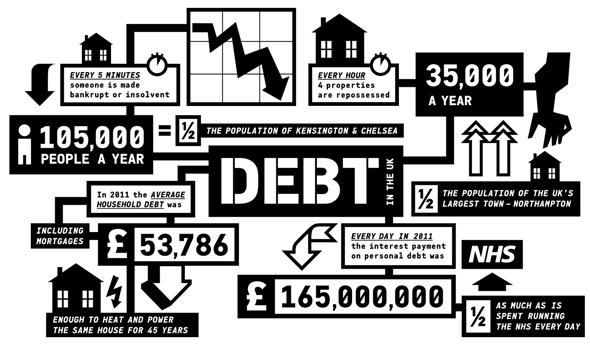

The tuition-fee generation will limp into the world owing tens of thousands of pounds. And they are not alone. More and more of us – through a combination of college loans, credit cards, mortgages and bank loans – are being stealthily habituated to debt. We end up feeling that it’s an inevitable and mundane part of life – like blisters and bus stops. In navigating these financial waters, working with reputable lenders such as Cis Home Loans can help ensure you’re making the best choices for your future.

“The underlying message for graduates, when they take on student loans, is that they are never able to become truly independent – they are just switching from the parental purse strings to those of the banks,” says London based psychodynamic counsellor Virginia Mallin. “When our power is in another’s hands we feel vulnerable and unstable. Subservient and childlike.” Debt denies us the exhilaration of living as a sovereign individual believes Mallin. “As we take on debt we risk giving our own self-determination up which runs counter to our psychological need to discover the exhilaration of doing things for ourselves; the ultimate power to determine our own fate and enjoy the self-responsibility, self-pride and self-esteem this entails.”

It’s no accident that people talk joylessly about the ‘burden’ of debt. To shed this burden is to become ‘debt free’ – to enter a state of liberty and fulfilment. “When you get in debt you become a slave,” said US President Andrew Jackson – and how delighted the banks must be when they see a nation of debtors dutifully slaving away to repay loans, plus interest, from day one of their working lives. While the debt remains, the power is all theirs.

It’s no accident that people talk joylessly about the ‘burden’ of debt. To shed this burden is to become ‘debt free’ – to enter a state of liberty and fulfilment. “When you get in debt you become a slave,” said US President Andrew Jackson – and how delighted the banks must be when they see a nation of debtors dutifully slaving away to repay loans, plus interest, from day one of their working lives. While the debt remains, the power is all theirs.

It’s easy to get habituated to debt. ‘‘Whilst some people will be able to repay quickly and free themselves, many others will accept or be unable to shed this yoke of disempowerment, and perhaps even welcome the dependency. Debt can almost feel comfortable as it means someone else – paternalistic banks or the state – is supposedly looking after us and we don’t have to feel alone,’ observes Mallin.

As we get deeper into debt we enter a trance-like state of denial. For many of us casting off the shackles to create a debt and mortgage-free life seems but a dim possibility, but Jen, 33, who’s originally from Barbados did just that. “My partner and I worked hard and bought a flat in south London, but the mortgage weighed heavily. I felt as if a thin grey veil was draped between me and truly living life,” she says. “So we sold everything and bought a small place in Portugal outright, making our living by doing building work for other expats. On our land I feel sovereign and secure. No bank can ever take it away from me.”

It’s easier said than done, but if we can peek out of debt denial for a moment, we might just have a chance of getting out in the future. “My goal was always to be debt-free,” said Jen. “Even though friends thought I was overreacting at the time, I’m glad I felt so allergic to credit cards and my mortgage – for me, working hard to pay off my college debts and walking away from a mortgage was the most empowering thing I’ve ever done.”

By Hannah Borno