The first signs of a UK movement focusing on debt emerged during a session organised by the OT at the Up the Anti conference on 1 December 2012. Titled ’Are “debt strikes” the future of anticapitalist resistance?’, the session utilised a more participatory format than others during the day. Following an introduction from Michael Richmond of the OT and comments from David Graeber (Strike Debt), Nick Mirzoeff (Strike Debt) and Jonathan Stevenson (Jubilee Debt Campaign), the session broke into a number of discussion groups involving the speakers and their audience.

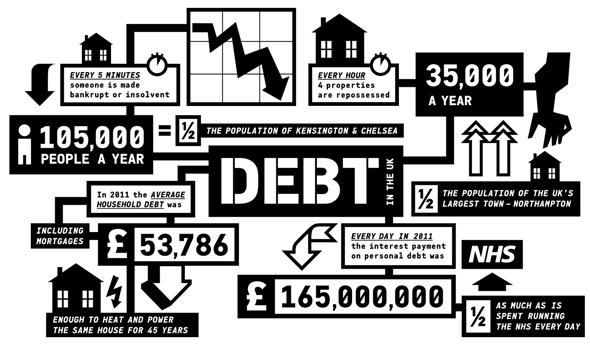

Graeber spoke to the nature of debt, its prevalence and impact on so many people’s lives, its stigmatisation and its place in the prevailing system of financial capitalism. Why are debt promises such as https://www.ivaonline.co.uk/ deemed as more sacred than other promises? How can we mobilise and bring people together around a subject which many consider shameful? How can we turn a ‘poor person’s movement’ into something which commands attention?

Ten million people in the UK are struggling with debt, living in the fear of the threat or real consequence of bailiff action and home repossession, those who can least afford it are paying back grossly inflated sums.

Nick Mirzoeff described how Strike Debt grew in America. Realising that debt could be a powerful tool of resistance to the status-quo, a small group formed out of public assemblies after May Day 2012. The US network developed ‘debt assemblies’ where people gathered to tell their personal debt stories and hear the debt experiences of others, encouraging the motif ‘You Are Not A Loan!’. Those involved in developing the Strike Debt US movement worked hard, collaborating on the Debt Resistors’ Operations Manual. We in the UK, with our different laws and regulations, perhaps need to mobilise around and draw up something similar.

Jonathan Stevenson highlighted the relevance of sovereign debt explaining the situation in Argentina which accumulated debt after purchasing weapons – from the UK – during the Falklands War. Argentina is still paying off this debt, opening itself up to debt restructuring in 2004, after defaulting. One vulture fund with an estimated holding worth $1.3 billion belongs to Paul Singer, a prominent sponsor of George W. Bush and Mitt Romney’s presidential campaigns. Singer, a hedge fund CEO, has aggressively pursued Argentina in courts across the world, allowing no opportunity for re-negotiation.

The discussion groups were asked to focus on a variety of topics: debt and its context in the political economy, debt awareness, debt resistance and other tactics to resist the injustices of a system which continually extracts more than we can give.

In the ‘debt and political economy’ group, Strike Debt, as a concept, was praised for its anarchic practice and approach. Marxists taking part saw value in the movement and its potential in mobilising the identity of the debtor as a new subjectivity, folding in ideas of wage stagnation and reliance on debt. There was some debate around this point relating to work and debt being the only two ideological tools that the ruling classes retain.

Different forms of debt were examined, sovereign and consumer debt, debt as credit, and how debt, in some sense, may be necessary. Credit unions were raised as an example. These types of financial institutions may resemble banks, but the manner in which they are run and organised are profoundly different. As credit unions are local financial co-operatives working on the common bonds of their account holder members, interest rates can be significantly lower (the law sets an APR no higher than 26.8%) than high street banks.

The nature of the Rolling Jubilee in the US – that is, fundraising for money to purchase debts from the secondary market and terminate the debt at a fraction of the cost – was also raised. There was a lengthy discussion about the capacity of the Jubilee to provide mutual aid and to build something larger, something with momentum and concrete effects. The limitations of the Jubilee were highlighted by many in the group since, by its very nature, a Rolling Jubilee is unable to change the debt system from the bottom up and is ineffective against market forces.

In the breakout group exploring actions around debt, participants expressed different ways of creating spectacle whilst scoping out the long term effectiveness and longevity of direct actions. Nick Mirzoeff spoke of how Strike Debt in the US launched soon after the May Day protests, when public angst, and sentiment, was at its most compelling.

People focused on the significant increase of payday loan stores now scattered along our high streets, the abusive practices of the companies behind them, and the absence of proper regulation by the Office of Fair Trading, the Ministry of Justice and the Financial Services Authority in relation to rampant interest rates and pre-loan checks. Wonga’s recent bad press exposing its manipulative and misleading advertisements, which the Advertising Standards Authority is responsible for investigating, was also raised as an interesting case study.

Several people in the group elaborated on possible action around sport. A number of football clubs and competitions have sponsorship arrangements with the best money making apps 2022, payday loan and other debt based companies. The class-based nature of this sponsorship was made clear: a payday loan company’s logo would not be splashed across a Formula One car. The imminent G8 summit in Northern Ireland was also noted as a possible event to highlight mobilising around debt. For this to happen, a great deal of careful advance planning and mobilisation of different groups would be necessary.

Turning to more practical aspects of Strike Debt UK, the group explored the technicalities of building a Strike Debt here. Can we, for example, buy discounted debt on the secondary debt market? Do we want to do this? What is the procedure? What are the relevant laws in England and Wales? Do we need a Debt Resistors’ Operations Manual here? Many of the questions raised in the group highlighted the need for people to come together, do the research, and share their findings in an accessible way. It also became very apparent that debt is becoming a popular tool in the resistance of capitalism, and as defaulting becomes more commonplace, we need to establish processes which will protect people, rather than financial institutions.

Strike Debt UK is a recent initiative. It can be found at www.strikedebtuk.com and @strikedebtuk. If you are interested in getting involved, please contact strikedebtuk@gmail.com.